Investing in farmland has long been considered a viable and tangible alternative to paper markets, particularly for investors who lean toward the conservative end of the risk spectrum. However, finding an efficient and cost-effective way to profit from agriculture presents some challenges unique to the industry.

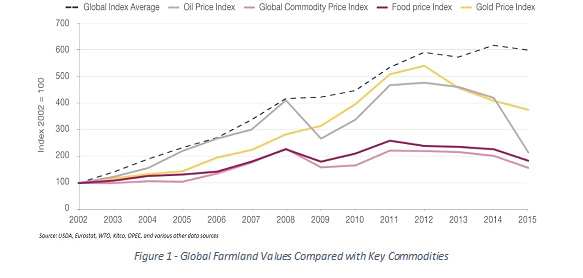

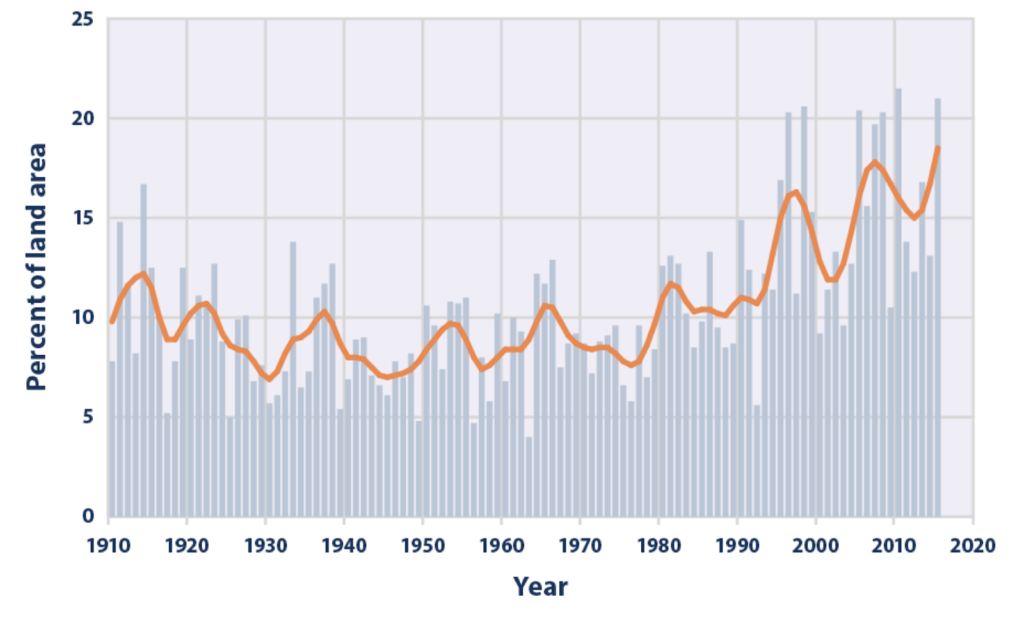

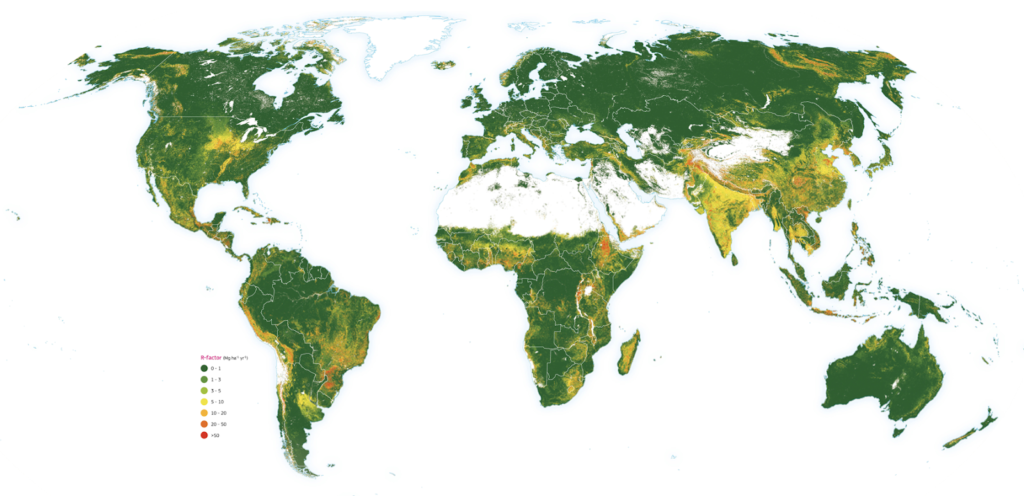

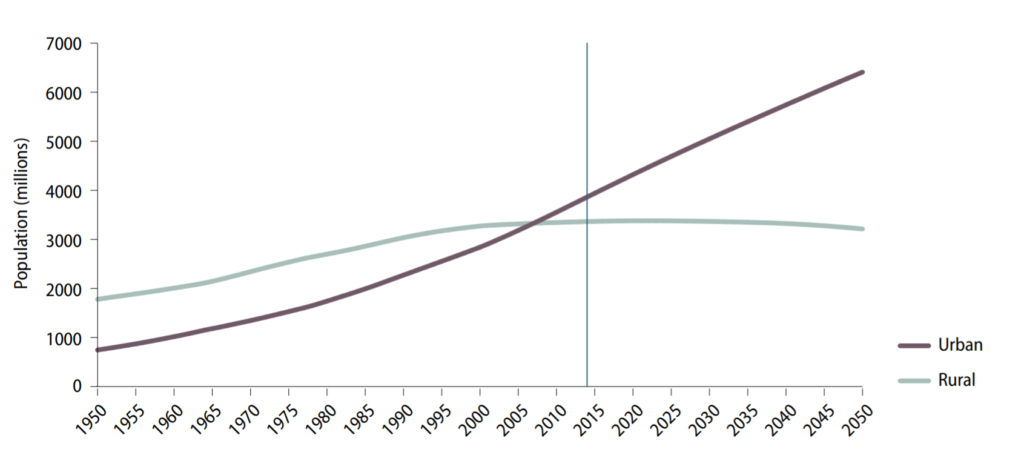

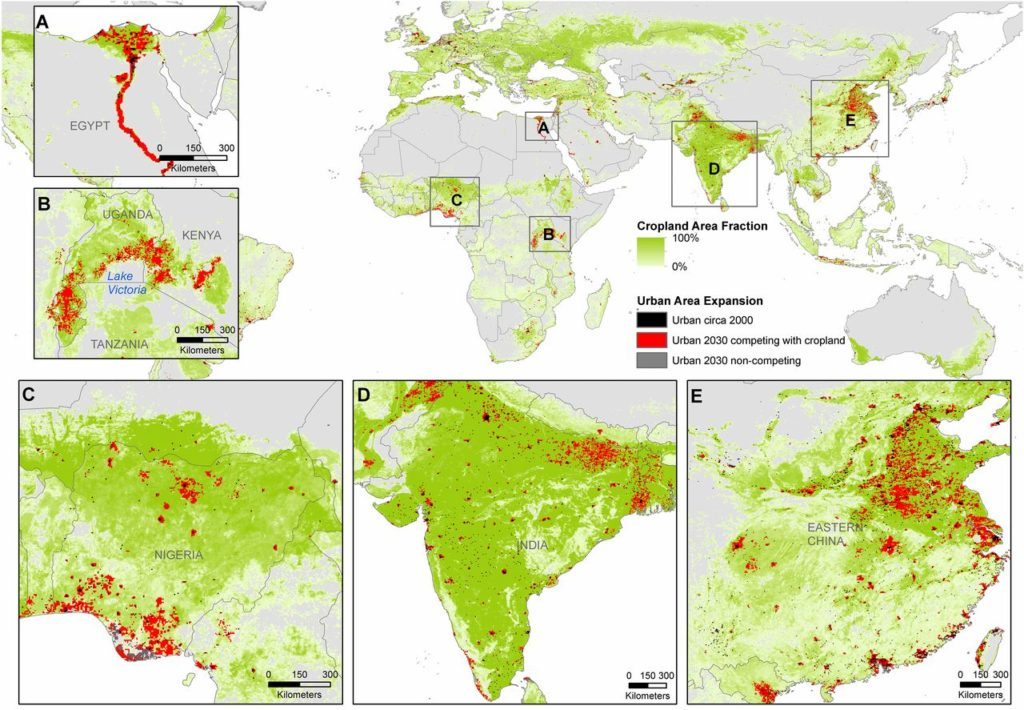

Owning farmland is the simplest and most direct way to invest in the agriculture industry. Agriculture has been an appreciating asset class for the last several decades. A Global Farmland Index developed by Savills World Research is comprised of data from 15 key farmland markets around the world. The index highlights an average annualized growth of 13.3% since 2002. Despite its strong return potential, nearly every acre of arable land in the country has either been converted for other purposes or is already in use as active farmland, making that acreage even more valuable. By 2030, urban expansion is projected to reduce global cropland by as much as 35 Mha (35 million hectares, or 74 million acres). Further, the cropland that will be lost is nearly twice as productive as the remaining land worldwide. In addition to the appreciation of the land itself, investors realize gains from the sale of crops harvested on their property.

Despite the clearly positive long-term investment potential of owning farmland, there are challenges to direct land ownership that cannot be ignored. Entering the agriculture industry in this fashion requires a large capital commitment that is beyond the means of the average investor. The time and expense of operating a farm are also often substantial, making ownership unrealistic for many. For these same reasons, investors who own farmland may struggle with liquidity when the decision is made to sell. Finally, direct farmland ownership comes with increased exposure to the cyclicality of commodity prices as well as operational risk.

Fortunately, a number of legitimate investment options exist for investors wishing to gain exposure to the agricultural sector in a way that doesn’t require titled ownership or operational management.

Alternative Agriculture Investment Vehicles

Land Lease Agreements

For investors who already own farmland, leasing property to another company or family willing to operate the land is an attractive opportunity. Operational risk can be transferred to the leasee and depending on how the lease is structured, property owners can benefit not only from predictable monthly lease payments, but also additional revenue generated from the sale of crops harvested from the leased land. For US farmland, attractive cap rates range between 3-5%. While incentives for the leasee to care for or improve the land long-term are limited, and the terms of operational control between the landowner and operator can be difficult to negotiate, it is a viable alternative for existing landowners wanting to reduce their operational risk and/or time commitments.

Real Estate Investment Trusts (REITs)

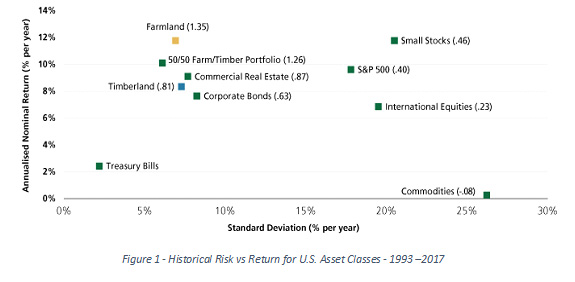

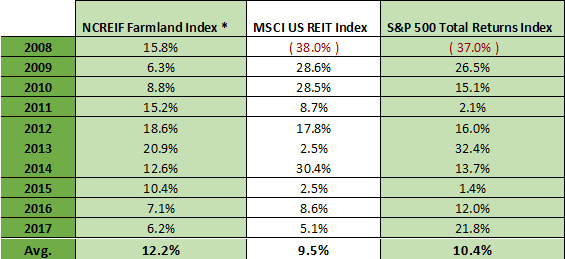

Investing in a REIT with exposure to the agriculture industry is another viable option. In 1971, US-based REITs had a total market cap of only $1.5 billion. At the end of 2017, the total market cap of all REITs listed on the New York Stock Exchange was $956 billion, a 63,633% increase. Currently, there are approximately 87 million Americans (44%of households in the US) who own REITs. Agriculturally-focused REITs typically purchase farmland then lease it to back to operators. REITs provide greater diversification than buying a single farm as they expose an investor to multiple assets across a wide geography. They offer greater liquidity than physical ownership, trading on many of the major stock exchanges, and can be purchased at prices much lower than acres of land. When it comes to agriculture REITs, two names dominate the space: Gladstone Land Corporation (LAND) and Farmland Partners (FPI). LAND was formed in 2013 and was the first publicly-traded REIT focused solely on investing in farmland. A year later, FPI was formed by Paul Pittman, a partner in a family-owned farming operation in Illinois. Both LAND and FPI lease property to farmers, but LAND is focused more on fresh produce farms in California while FPI is focused on MidWest row crops. Over the past five years, LAND has significantly outperformed FPI, with a return of 12.5% compared to FPI’s -41%. The liquidity benefit of a REIT’s tradability on the stock market also makes it more closely correlated to that market. If stocks go down, REITs are likely to follow suite, whereas farmland typically remains steady or even rises when equities fall.

Mutual Funds and Exchange Traded Funds (ETFs)

Mutual funds and ETFs present another practical option for investors looking to add agriculture to their portfolios. Mutual funds are actively managed or passively chosen portfolios of stocks, bonds, and other securities that invest a portion of a shareholders’ money into related sectors, although it is important to note that no actively managed fund tracked by Morningstar invests exclusively in agriculture. The Invesco DB Agriculture Fund, comprised mostly of commodities, is one of the largest ag-focused mutual funds. The fund is down by nearly 5% over the last 10 years, largely due to depressed commodity prices, trade wars with China, and weather volatility. Many of these mutual funds charge fees and have exposure to other agriculture-related firms and products, so interested investors must decide how much pure farmland exposure they want compared to other ag-related products (crop inputs, technology, equipment, distribution, processing, etc).

Agricultural ETFs can also be actively or passively managed and are comprised of a diversified set of ag businesses who derive substantial portions of their revenues from farming or related agricultural endeavors. The VanEck Vectors Agribusiness ETF is the largest agricultural index fund and returned an annual average of 7.3% for the last 10 years ending in September. Like mutual funds, investors should carefully consider each EFT’s management fees and the performance of the index they track.

Crowdfunding

Unlike the investment options described above, crowdfunding is a relatively new concept when it comes to alternatives ag investing, signed into law as part of the Jumpstart Our Business Startups (JOBS) Act of 2012. As a law intended to encourage funding of small businesses in the US by easing securities regulations, Title III of the act – the CROWDFUND Act – has drawn notable attention. This law created a way for companies to use crowdfunding to issue securities, something not previously permitted.

Historically, when a farmer or agribusiness operator needed to raise capital for expansion or improvements, the only options outside friends and family were traditional ag lenders or in some cases, venture capitalists. The problem is that there are a limited number of ag-specific lenders and the criteria for loan approval has become increasingly more strict with each passing year. In addition to customary lending requirements, demonstration of a farmer’s skills and experience are often necessary, as well as a character evaluation to determine if any “moral hazard risks” exist. This is often coupled with mandatory non-real-estate collateral assignments, personal guarantees, liens on crops, co-signers, and subrogation of existing first-level loans or financing arrangements.

Crowdfunding presents an opportunity for business owners to solicit capital from a much larger pool of smaller investors with fewer restrictions while providing investors the opportunity to add agriculture to their portfolios with less up-front capital and greater liquidity. Specifically, with equity crowdfunding, the investor receives shares of a company in exchange for money pledged. In agriculture, these companies can perform a variety of functions – farmland operation, ownership with outsourced management, agribusinesses across crop types and the value chain, and more.

Unlike traditional equity shares, however, crowdfunding investors are not given voting rights or any other decision-making capabilities with respect to the day-to-day operations of the company. Additionally, the JOBS Act implemented restrictions on how much money non-accredited investors can invest over the course of a given year, based on the individual’s income and net worth. The purpose of these limitations was to prevent less sophisticated and non-accredited investors from taking on too much risk and potentially threatening the stability of their financial future.

What is Available Today and Is It Right for Me?

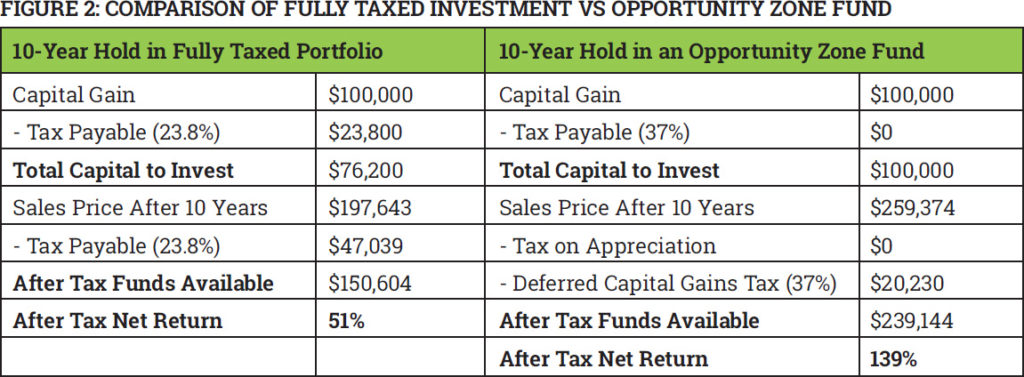

There are several ag crowdfunding platforms on the marketplace today. Founded in October 2016 and based in Fort Worth, Texas, Harvest Returns is an equity crowdfunding platform dedicated to ag investments. According to their CEO Chris Rawley, Harvest Returns provides “flexible debt and equity funding for specialty farmers while making access to private placements in agribusiness more accessible to investors.” Unlike FarmTogether and FarmFundr, Harvest Returns offers international deals to a userbase of over 3,700 subscribers. To date, Harvest Returns has raised US$2.3 million across three continents and seven projects, including cacao in Ghana and Belize, cattle in Kansas and Georgia, bamboo in Florida, organic hemp CBD in Colorado, and hydroponic produce in Kentucky. One of their current offerings is a Sustainable Agriculture Opportunity Zone Fund focused on the US (starting at $25,000). The company charges listing fees to syndicators to keep the deal live on the platform as well as carried interest from the offerings. Minimum investments into deals range from $5,000 to $25,000. The risks associated with this approach are the capability of the management team to execute on their offering and the liquidity of the investor’s shares of the LLC or SPV. However, many of these platforms are trying to solve this by building large user-bases to whom they can offer rights-of-first-refusal to should another investor need/want to exit. Most of the deals require some lock-up period for funds.

FarmFundr led by Brandon Silveira, is an equity crowdfunding platform focused on specialty crop operations in the US. Founded in February 2016 and based in Fresno, California, FarmFundr chose to differentiate itself by offering farmland ownership opportunities to investors while contracting out the operational management. This approach is common overseas including cacao in Belize and specialty crops in Panama, but FarmFundr is the first to have US offerings. According to Silveira, “we hire a farm manager to handle everyday operations and decisions. Instead of lease income, our investors have ownership of the property, the crop, and the profits.” FarmFundr’s business model charges a fee on capital raised, from the sponsor as well as the investor. According to Silveira, “something that makes us unique is that we pre-fund farmland offerings with no fees to the investor. Instead, we retain an equity position and share the risk alongside our investors.” Both FarmFundr and FarmTogether offer the ability to pre-fund offerings and to date, all three firms take equity positions in the deals they fund. Minimum investments into deals range from $10,000 to $30,000 and current options include an almond orchard, pistachio development and a row crop farm, all in California. This approach does come with the inherent operational risk of owning farmland directly, exposes the investor to commodity price fluctuations, and presents the challenge of liquidating a fractional percent of a larger operation.

Led by Artem Milinchuk, FarmTogether was founded in late 2017 and also focuses on US farmland as an asset class. FarmTogether’s model is one where investment offerings are legal entities, typically LLCs, that own titles to the investment properties. When FarmTogether investors commits capital into a deal, they purchase shares in an LLC and become fractional owners of the farmland property, entitling them to the property’s returns from operations and/or rental income. This is the same model employed by Harvest Returns. Investments on the platform generally start at $25,000, and their platform currently has two crowdfunding opportunities available: a row crop property and a mandarin property. The company also offers separately managed accounts and facilitates 1031 transfers for clients looking to invest $500,000 or more into farmland. Based in San Francisco, California, FarmTogether closed its first offering in September 2019, an almond orchard in Merced County, California, which was 30% oversubscribed. According to Milinchuk, FarmTogether’s two biggest differentiators are their team and technology. “Our team is comprised of investment professionals who have institutional-investment expertise at marquis firms including Prudential, Ontario Teachers’ Pension Plan, and AMERRA Capital.” Milinchuk is also utilizing technology to source deals and perform diligence, the only ag-focused crowdfunding platform to do so. “Our tech team is building an AI-enabled sourcing and diligence engine to assist us in identifying properties for acquisition and capital improvement.” Through AI, Milinchuk expects to decrease due diligence expenses and increase returns for clients. The model generates fees from the services provided to clients and typically includes reimbursements for administrative costs related to the acquisition and management of the property.

The Risks

As with any investment methodology, its merits and risks must be weighed against an investor’s return expectations and risk tolerance. The softening of registration requirements combined with the ease of publication and promotion for deals to non-accredited investors, presents the opportunity within equity crowdfunding for illegitimate actors to solicit investors with lower quality projects. As a result of looser oversight, the possibility for loss of principle with crowd-funded deals is greater than with other alternatives.

The JOBS Act does not leave investors to fend completely for themselves, however, still limiting the amount of money a syndicator can raise in a 12-month period to $1 million, and requires syndicators to either use a qualified intermediary (internet platform registered with the SEC as a broker/dealer) or a newly created Funding Portal, also required to be registered and regulated by the SEC. Investors can change their minds within 48 hours of the close of the raise and syndicators are required to provide annual reports to the SEC.

Investors must carefully weigh the risks and rewards of investing in a new sector like crowdfunding before jumping in. It is advisable that they consult a financial professional or expert in the sector to help guide them through the process.

Conclusion

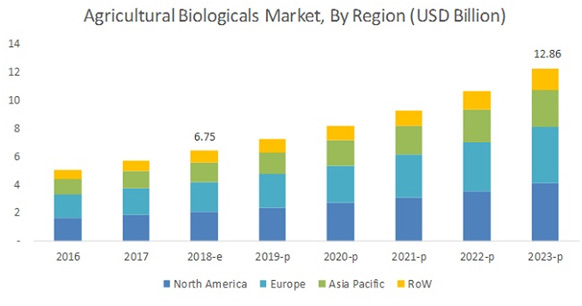

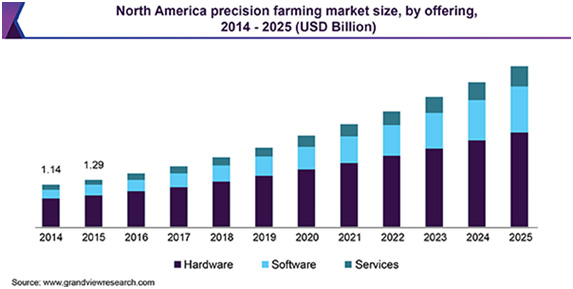

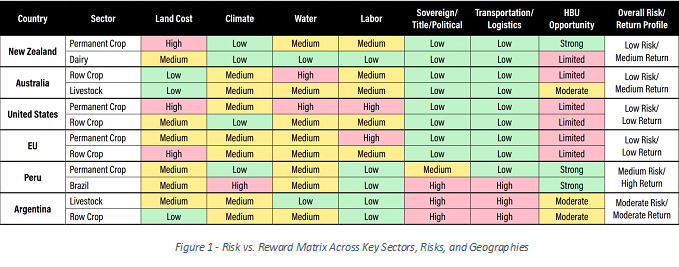

The inevitabilities of a growing middle class, changing demands for higher quality foods, entrenched consumer concerns with sustainability and traceability, and the continued competition for key resources are all unmistakable value drivers that underpin the agricultural sector, particularly farmland. In order to rise to these challenges, agricultural producers will need to innovate, an endeavor requiring substantial financial outlays from investors who understand the importance of food production. Equity crowdfunding platforms are slowly emerging as solutions where more investors can help contribute to these necessary innovations at lower costs to entry and greater liquidity while reaping the rewards of an expanding sector.