Brazilian Farmland – Is the Risk Worth the Reward?

By Michael DeSa, Founder of AGD Consulting, and Monica Ganley, Principal at Quarterra

Click here to view the article on Global AgInvesting’s website

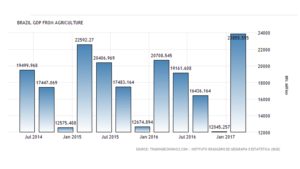

In recent years, Brazil has solidified its role as a global agricultural powerhouse. It has become the world’s largest exporter of soybeans, coffee, and sugar, as well as the second largest overall food producer on the planet. Over the past 15 years, Brazil has increased agricultural production by 156 percent with overall Gross Domestic Product (GDP) from agriculture reaching an all-time high in the first quarter of 2017.1 The agricultural sector as a whole accounts for nearly 6 percent of Brazil’s total GDP and employs nearly 16 percent of their total labor force.2 It is also the only sector that has continued to grow despite the current recession.3

Is this enough, however, to draw investors into a country and an economy in the midst of economic and political discourse? The economic crisis, which began in early 2015, coupled with the ongoing political turmoil, have forced Brazil into difficult times. In 2015 and 2016 Brazil’s GDP declined – the first time since 1931 that the country’s GDP has fallen for two consecutive years.

Figure 1: Brazil’s GDP (2010 – 2016)

However, the World Bank expects Brazil to slowly emerge from the recession by the end of 2017; restoring investor confidence and recovering lost ground could take much longer.

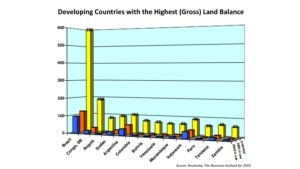

Brazilian Farmland – Is it Still for Sale?

While Brazil has begun in earnest to develop its frontier farming regions, there still remains millions of hectares left to be developed. Brazil’s total arable land area nears 600 million acres with only 170 million acres presently cultivated. One side of this coin seems to indicate that there is more than ample room for the development of viable agricultural land to meet a growing demand. With the world’s population expected to reach nearly 10 billion people by 2050, Brazil’s millions of hectares of undeveloped land could become the southern hemisphere’s next bread basket.

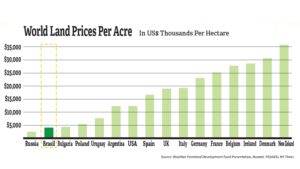

Farmland prices are also an attractive part of this equation, and is the primary reason for foreign investment by groups such as the Brazil Farmland Development Fund. According to Matthew Kruse, President of the fund, their land appreciated at nearly 3x within a ten-year timeframe in their previous investment. According to Kruse, “we can purchase land at less than U$1,000 per acre. That is a fraction of comparable land costs in parts of the Midwestern United States. We are confident that we are purchasing land with the same productivity potential but at one-tenth the cost.” Given that the average price for an acre of U.S. farmland is US$7,183, according to the 2016 Iowa Land Value Survey Results, farmland in Brazil is presently some of the most affordable in the world.

The other side of the coin begs the question – if land is so plentiful and affordable, and it’s the only sector in Brazil’s economy that is presently growing, why hasn’t this development happened yet?

Financing in Brazil is neither common nor readily available, thereby limiting the average Brazilian’s ability to purchase and develop raw land. There are no government subsidies for agriculture in Brazil either. Land development can be very expensive, requiring either independent wealth, foreign investment, or debt financing to accomplish, the latter of which is largely not an option. Wealthy Brazilians do not account for a sizable enough population to make a substantial impact in development statistics.

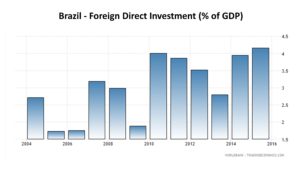

These factors have resulted in a much smaller pool of available capital capable of developing Brazilian farmland, leaving foreign investment as a significant source of land development capital in Brazil. This pool of capital has been growing during the last couple of years, making Brazil the world’s eighth largest destination for Foreign Direct Investment (FDI) in 2015,4 and could indicate that investors are again ready to take the plunge.

In spite of a growing agricultural sector, attractive farmland prices and increasing foreign investment flowing into the sector, the decision to invest in Brazilian farmland is still very much a risk versus reward consideration.

Understanding the Risks

While Brazil offers a compelling opportunity for agricultural investors, operating within the country carries unique challenges. To be successful, investors must be cognizant of these risks and become either comfortable with the potential impacts, or confident that they have a robust mitigation strategy in place. Although agricultural investments worldwide are subject to volatility stemming from a variety of sources, including weather and fickle commodity markets, investments in Brazil are subject to unique idiosyncratic risk as well, particularly due to the political environment, foreign exchange fluctuations, and liquidity issues.

Brazil’s chaotic political machine has been thrust into the international spotlight repeatedly in recent years as widespread corruption scandals have led to the indictment of one former president, the impeachment of another, and have left the current president with dismal approval ratings. Just a decade ago, Brazil was the darling of Latin America, posting GDP growth that frequently topped 5 percent. However, the prevailing concern, given the country’s poor economic performance during the last couple of years, is that these ongoing political scandals will inhibit the country’s recovery, thus impacting investment performance.5

In addition to impeding overall economic performance, an unstable political system can introduce additional risks that must be considered with any potential investment in Brazil. One poignant example is the regulation of foreign land ownership – an issue that carries particular socioeconomic sensitivities throughout resource-rich Latin America. In 2010, over concerns that land purchases by international investors were leading to disproportionate foreign control of Brazil’s agricultural resources, then President Luiz Ignacio Lula da Silva restricted purchases of farmland by foreigners. This move resulted in the area of agricultural land bought or leased by foreigners not being able to account for more than 25 percent of the overall land area in a given municipal district, according to the National Land Reform and Settlement Institute (INCRA). Additionally, no more than 10 percent of agricultural land in any given district may be owned or leased by foreign nationals from the same country.6

While the rules still allowed access after clearing a number of bureaucratic hurdles, this greatly increased transaction costs associated with these investments. Although these rules have since been adjusted, smart investment managers have developed ways to overcome these hurdles, such as the Brazil Farmland Development Fund (www.brazilfarmlandfund.com), who have developed a strategy to allow for foreign investment into Brazilian farmland. However, the political risk here still goes to the heart of the viability of these investments. If the political winds shift, it could affect a factor as fundamental as an investor’s legal claim to their asset.

Political risk also can manifest at a more granular level. Many of Brazil’s institutions are weak by Western standards and it is no secret corruption exists in many corners of the country. For a reminder, one needs to look no further than the ‘Weak Flesh’ sting that devastated the country’s meat packing industry in March 2017. This police investigation into the industry found widespread food safety offenses and bribery, resulting in the indictment of 60 individuals and the loss of an estimated $1.5 billion USD in export revenue for the beef and poultry sectors.7 Understanding that these risks are pervasive and having the ability to build operational mechanisms to prevent them where possible, and implement strategies to identify and address them where not, will be critical for investor success in Brazil.

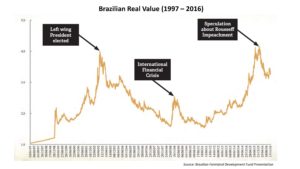

Closely tied to political and economic evolution, and a critical factor in calculating investor returns, is the value of the Brazilian real. The real, as we know it today, was introduced in the mid 1990s and since then has fluctuated with the fiscal and monetary policies of the government.

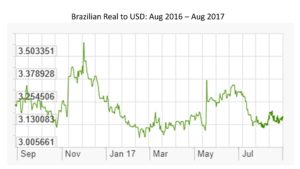

While the currency had been experiencing a period of relative strength in late 2016, the resurgent corruption issues led to its rapid devaluation in June 2017.

Currency movements can impact investments in a number of ways, which can be either favorable or unfavorable to investors. Most obviously is that the relationship between the real and an investor’s base currency can influence the value of an investment. Currency risk comes into play when its change affects the underlying price of the asset in the period between the initiation and the retirement of the investment.

Currency risk plays another role, especially with respect to agricultural investments. In many cases agricultural investments are attractive, not only for the underlying asset, but also for the operating income that the asset creates. For example, in the case of a farm that produces soybeans, not only is the value of underlying farmland important, but also the value of the annual soybean crop. In this case, the value of the Brazilian real has an important impact on the value of the annual soybean crop. Since many agricultural goods are traded on global markets, they are denominated in U.S. dollars. As a result, a weak Brazilian real will encourage additional export demand as the crop will be artificially inexpensive in global terms. A strong real will have the opposite effect. Depending on the nature of their investment, investors may be able to manage some currency risk using financial tools such as those available through futures markets.

While many investors who choose agricultural investments are looking for long-term opportunities, sooner or later they may want to exit the investment. At this point, liquidity concerns with farmland assets can come into play. An asset is only worth as much as someone is willing to pay for it, and particularly in the case of larger farms, the pool of potential investors may be limited. To limit the impact of this risk, investors will be wise to maintain the value of their investment by performing necessary maintenance and making improvements to protect the operation. In addition, for an investor with flexibility of timing, staying close to the market can help identify the ideal moment to sell.

Is Now the Time?

The decision to invest in Brazil’s agricultural sector requires investors to strike a balance between opportunity and risk. While Brazilian farmland prices are more attractive now than they’ve been in years, owning land as a foreign investor in Brazil is still difficult and highly regulated. The agricultural sector as a whole has seen continued growth in spite of an economic downturn, but a continued slide toward slower growth or further political turmoil will inevitably begin to affect the sector. There are currency factors at play that can be either a hindrance or a help, depending on your base currency and the type of investment. For every positive, there is a direct counter-point that must be considered.

The rewards are promising for bold, first movers, but every investor must carefully weigh each risk before jumping into the murky agricultural investment waters of Brazil.

ABOUT THE AUTHORS:

Michael DeSa is the founder and CEO of AGD Consulting, a U.S.-based, veteran-owned firm offering strategic advisory services and customized due diligence trips for investors seeking exposure to Latin American agriculture. DeSa is an experienced LatAm land owner, former Marine Corps Officer, and family farmer. He has years of technical management experience with the Marine Corps from his assignments in Djibouti, Jordan, Afghanistan, and throughout Latin America. DeSa can be reached at michael@desaconsultingllc.com.

Monica Ganley is the principal at Quarterra, a boutique consulting firm offering international strategic planning, research and business development services to organizations and individuals in the agriculture and food space. Ganley is passionate about the food and agricultural industries and has pursued a dynamic career with experiences ranging from agricultural production to consumer products spanning many geographies. She holds an MBA from the University of Chicago Booth School of Business and currently resides in Buenos Aires. Ganley can be reached at monica.ganley@quarterra.com.

SOURCES:

1Yara International. “Agriculture in Brazil – Vast Resources.” YouTube. 13 June 2014. 28 August 2017. https://www.youtube.com/watch?v=KlI2JwhI1JU.

2World Bank. “Global Economic Prospects – A Fragile Recovery.” World Bank. June 2017. 28 August 2017.

3“Brazil Farmland Development Fund Pitchbook, (www.brazilfarmlandfund.com) 01 August 2017.

4Export.gov. “Brazil – 1- Openness to and Restriction on Foreign Investment.” State Department’s Office of Investment Affairs’ Investment Climate Statement. 31 July 2017. https://www.export.gov/article?id=Brazil-openness-to-foreign-investment. 28 August 2017.

5“How to Cope with Brazil’s Political Crisis.” The Economist. 25 May 2017.

6Ibid.

7Welshans, Krissa. “JBS SA Resuming Operations as 60 Indicted in Brazilian Meat Scandal.” Feedstuffs. 21 Apr 2017.